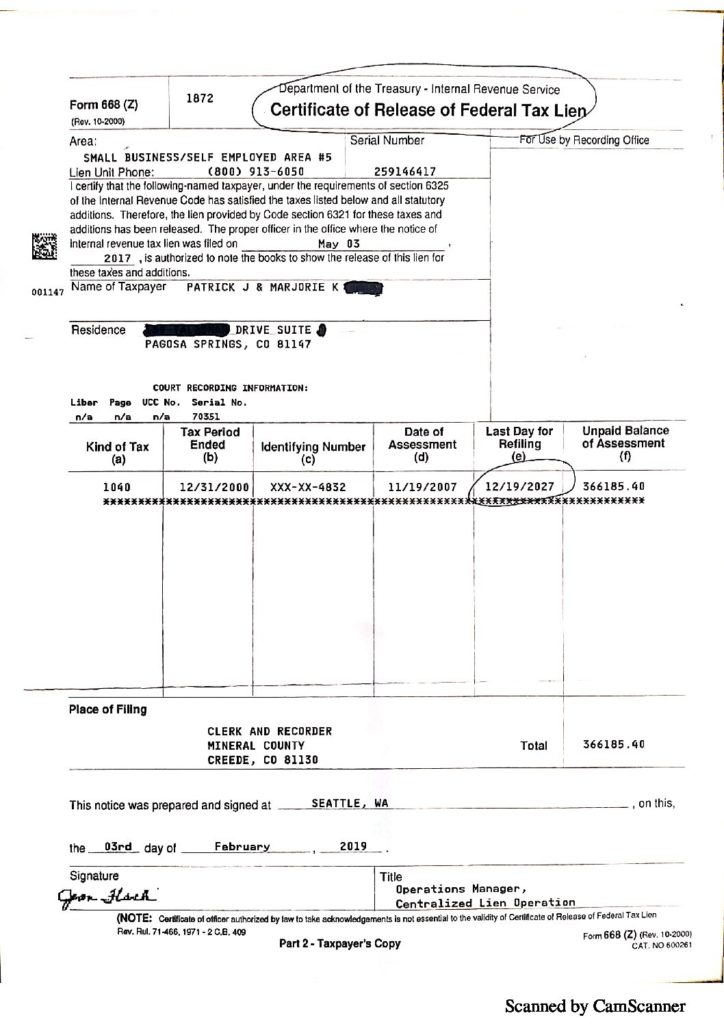

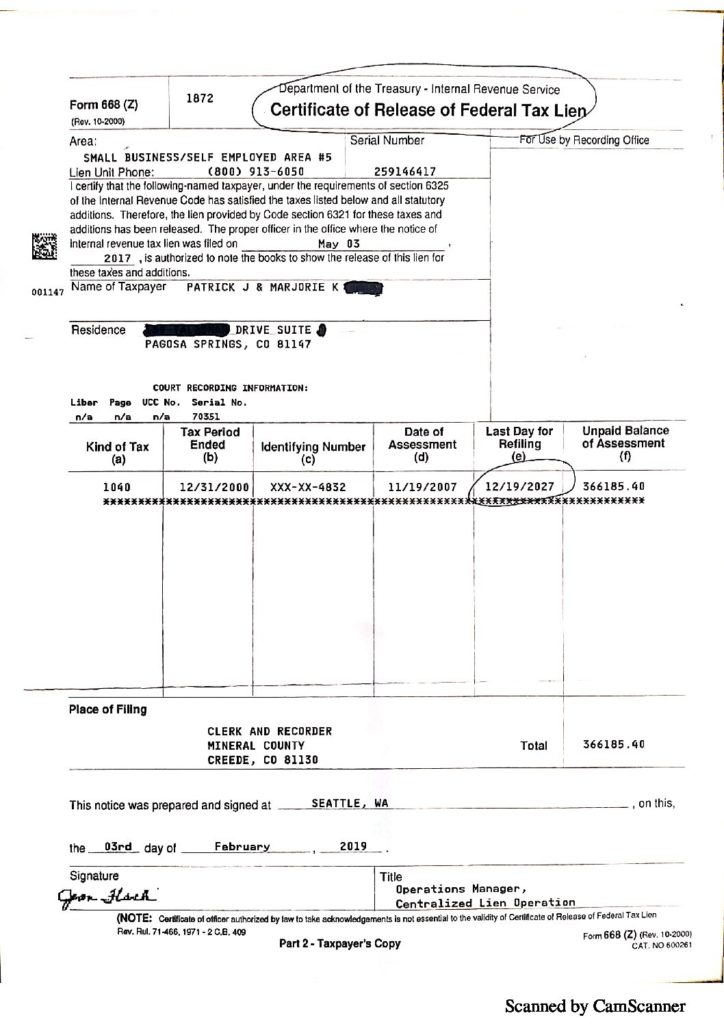

We challenged the IRS agent that created the assessment and the lien, in affidavit form, notary presentment with threat of litigation, lien was released. SEE lien as attached.

We challenged the IRS agent that created the assessment and the lien, in affidavit form, notary presentment with threat of litigation, lien was released. SEE lien as attached.

I am interested in your lien release process. Can you give me the details and cost of your time in a Assisting me with your process. Thank you

>> Hansen’s Response – the lien package is 35$, most people do not need my aid in utilizing the example letters and notifications and process of delivery. Some do, that is 35$ per hour for my time.

I have Notices of Tax lien against the name. I applied for a passport and was denied due to a “seriously delinquent tax debt” (2008 and 2009).

I need to have the liens removed. How can you help me?

>>>> Hansen’s Comments – There are several ways we can force them to remove liens that lack due process, and we have ways of getting passports without a SSN so that they can not lock them down administratively.

Interested in getting the passport without ssn, I too had large tax liens wasn’t denied but wasn’t granted.for passport, but none was ever issued, kept trying to have me produce documents that I have one. My name i different from birth name. I filed in US Tax court in which the attorney for irs commissioned agreed they did not do what was necessary to have nor can find proper paperwork However I haven’t sent court decision in yet to IRS. Because other who have they are still not removing from records. I would like the pkg you offer if it i important that I have. What I am really after is getting the passport without ssn,, Another issue id that m DL is soon to expired I have moved to another state and need to purchase an automobile, how do I protect myself from tge new state laws. Everywhere I go to purchase says I need a dl from the state.

Can the IRS take a person’s CA State pension if they say money is owed — money in the hundred’s of thousands from mortgages we lost in the 2008 debacle (even though we put 15-20% down on), and then lost? They are saying we need to prove their claims, and we cannot. We no longer have the paperwork. It was lost. Can your process help?

Thank you,

Caroline